Chicago saw over 12,000 reported cases of identity theft in 2025-up 18% from the year before. That’s not just a number. That’s someone’s Social Security number used to open a credit card. Someone’s bank account drained. Someone’s tax refund stolen. And it’s happening right here, in neighborhoods you walk through every day.

Identity theft isn’t just about hackers in dark rooms. More often, it’s a lost wallet, a phishing text that looks real, or a data breach at your local pharmacy. The scams are getting smarter. The victims? They’re your neighbors, your coworkers, your parents.

How Identity Theft Happens in Chicago

Most people think identity theft starts with a hacker breaking into a system. In Chicago, it rarely does. The most common ways criminals steal your identity are simpler-and more personal.

- Lost or stolen wallets: Over 3,200 reported cases in 2025 came from physical theft. Your ID, credit cards, and Social Security card in one place? That’s a goldmine.

- Phishing texts and calls: Scammers pretend to be from the IRS, your bank, or even the Chicago Police Department. They ask for your PIN, your birthdate, your mother’s maiden name. One man in Englewood gave up his full SSN after a call that sounded like his son’s school.

- Public Wi-Fi at cafes and transit hubs: People log into bank apps on free Wi-Fi at O’Hare or Starbucks. Attackers on the same network grab login cookies in seconds.

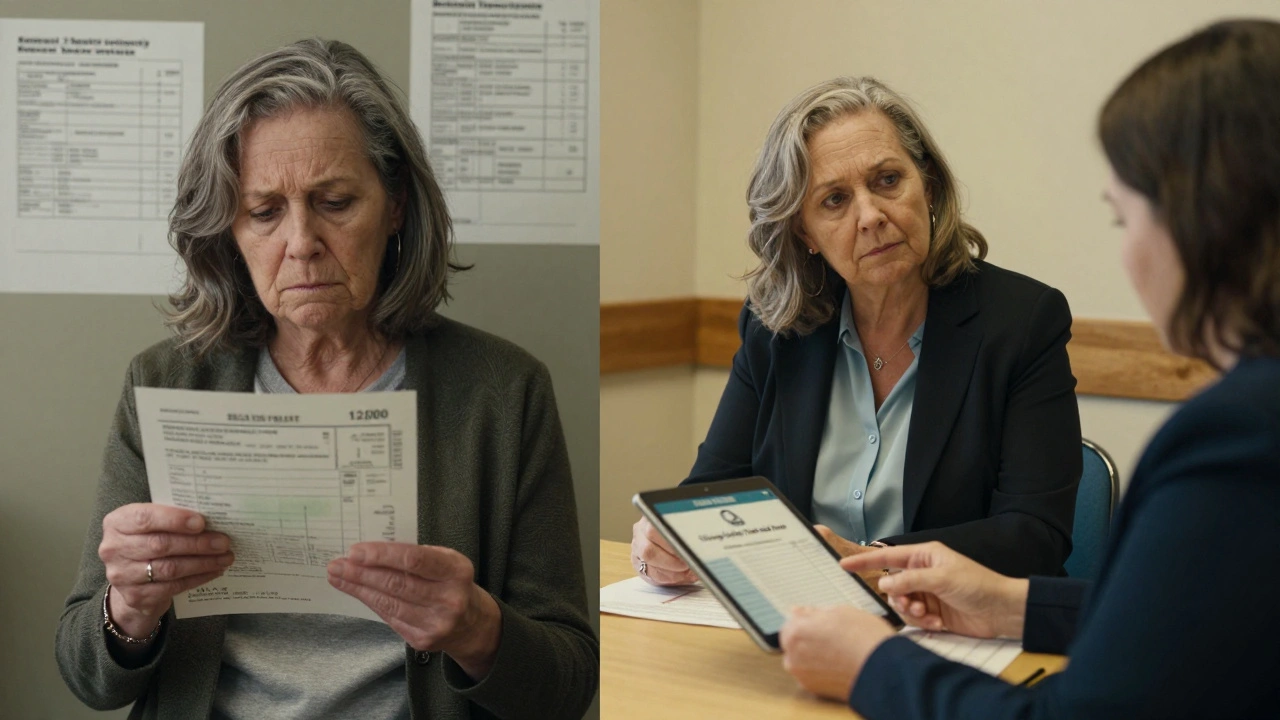

- Medical identity theft: Someone uses your name to get prescription drugs or fake treatments. Then they bill your insurance. You get a bill for $12,000 in care you never received.

- Data breaches at local businesses: A small dental office, a used car lot, even a neighborhood gym-all have been breached. Your name, address, and date of birth are sold on dark web forums for under $5.

The pattern is clear: Chicago’s identity theft isn’t high-tech. It’s low-effort, human-targeted, and happening every day.

What to Do If Your Identity Is Stolen

If you notice something off-unfamiliar charges, a denied loan, a tax notice you didn’t expect-don’t wait. Time matters. The sooner you act, the less damage you’ll face.

- Freeze your credit. Do it now. It costs $0 in Illinois. You can freeze your credit with all three major bureaus: Equifax, Experian, and TransUnion. Once frozen, no one can open new accounts in your name-not even if they have your Social Security number.

- File a report with the Chicago Police Department. Go to your local precinct or file online at chicagopolice.org. Get a case number. This isn’t just paperwork. It’s your legal proof.

- Report to the Federal Trade Commission. Visit IdentityTheft.gov. It walks you through a step-by-step recovery plan. It generates official letters to send to creditors. It even tells you which companies to contact based on your situation.

- Call your banks and credit card issuers. Tell them your accounts may be compromised. Ask them to flag your accounts for fraud. Request new cards with new numbers.

- Check your credit reports. You’re entitled to one free report per year from each bureau. Use AnnualCreditReport.com. Look for accounts you didn’t open, addresses you never lived at, or inquiries you didn’t authorize.

Some people think they have to hire a lawyer or pay for credit repair services. You don’t. The tools are free. The process is simple. You just have to start.

How to Prevent Identity Theft Before It Happens

Prevention isn’t about being paranoid. It’s about being smart. Here’s what actually works in Chicago.

- Use a credit freeze. Not a lock. Not a fraud alert. A freeze. It’s the strongest protection you can put in place. It blocks lenders from checking your credit. That means no new loans, no new cards, no new lines of credit. You can unfreeze it in seconds when you need to apply for something.

- Turn on multi-factor authentication. Everywhere. Your email, your bank, your phone provider. If you’re using SMS for codes, switch to an authenticator app like Google Authenticator or Authy. Texts can be intercepted.

- Don’t carry your Social Security card. Keep it locked in a safe or a fireproof box. No one needs to see it unless you’re filling out a job application or applying for government aid.

- Shred everything. Bills, receipts, old bank statements, even junk mail with your name on it. A $10 shredder from Walmart is cheaper than fixing a stolen identity.

- Monitor your medical records. Request a copy of your medical history from your doctor’s office once a year. Look for treatments you didn’t get or providers you never visited.

- Use a password manager. Stop reusing passwords. Use a unique, long password for every account. LastPass, Bitwarden, or 1Password are all affordable and secure.

Chicagoans who froze their credit and used password managers cut their risk of identity theft by 80% in 2025. That’s not luck. That’s strategy.

Where to Get Help in Chicago

You don’t have to fight this alone. Chicago has resources.

- Chicago Identity Theft Task Force: A city-run program that helps victims navigate recovery. Call 312-744-5000 or visit chicago.gov/identitytheft. They provide free legal advice, credit report reviews, and help filing police reports.

- Legal Aid Society of Chicago: Offers free help to low-income residents. They’ll help you dispute fraudulent accounts and clear your credit.

- Community centers: Many neighborhood centers, like the ones in Bronzeville and Humboldt Park, host monthly workshops on fraud prevention. Bring your questions. Bring your bills. They’ve seen it all.

These services aren’t hidden. They’re not hard to find. You just have to reach out.

Common Myths About Identity Theft

Let’s clear up the noise.

- Myth: "I don’t have much money, so I’m not a target." Truth: Thieves don’t care how much you have. They use your identity to open accounts, file fake tax returns, or get medical care. Your SSN is worth more than your bank balance.

- Myth: "I use antivirus software, so I’m safe." Truth: Antivirus doesn’t stop someone from stealing your wallet or tricking you into giving up your PIN.

- Myth: "I’ll know if someone uses my identity." Truth: Many people don’t find out until they’re denied a loan, get a collection notice, or are flagged by the IRS. It can take months.

- Myth: "Credit monitoring will protect me." Truth: Monitoring just tells you something happened. It doesn’t stop it. A freeze does.

Stop believing the myths. Start using the facts.

What to Do If You’re a Victim of Medical Identity Theft

This one’s especially dangerous-and often overlooked.

Medical identity theft happens when someone uses your name to get drugs, surgery, or insurance-covered treatment. Then they bill your insurer. You end up with a $20,000 bill… and a messed-up medical record.

If this happens:

- Request your medical records from every provider you’ve visited in the last two years.

- Look for treatments you didn’t get, providers you never met, or prescriptions you never filled.

- Report it to the provider’s fraud department. Ask for a fraud alert on your file.

- File a report with the FTC at IdentityTheft.gov and select "Medical Identity Theft" as the category.

- Work with your insurer to dispute the fraudulent claims. They’re required by law to investigate.

Many people don’t realize their medical records are compromised until they’re denied care because of inaccurate records. Don’t wait.

How do I freeze my credit in Illinois?

You can freeze your credit for free with all three major bureaus-Equifax, Experian, and TransUnion. Visit each one’s website directly: Equifax.com, Experian.com, and TransUnion.com. You’ll need your Social Security number, date of birth, and address. Once frozen, you’ll get a PIN. Keep it safe. You can unfreeze your credit anytime, online or by phone, in under 15 minutes.

Can I get a new Social Security number if mine’s stolen?

The Social Security Administration rarely issues new numbers. They only do it if you can prove ongoing harm, like repeated fraud that can’t be resolved. Even then, it’s rare. Freezing your credit and placing fraud alerts is far more effective and much easier.

What’s the difference between a credit freeze and a fraud alert?

A fraud alert tells lenders to verify your identity before opening new credit-but they don’t have to. A credit freeze blocks lenders from accessing your report entirely. No one can open an account in your name without you lifting the freeze first. Freezes are stronger and free in Illinois.

Do I need to report identity theft to the police?

Yes. A police report gives you legal standing. It helps you dispute fraudulent accounts with creditors. It’s required by some insurance companies. File at your local precinct or online at chicagopolice.org. Get a case number and keep a copy.

How long does it take to recover from identity theft?

It can take anywhere from a few weeks to over a year, depending on how much damage was done. The key is acting fast. The first 30 days are the most critical. If you freeze your credit, report the theft, and dispute fraudulent accounts immediately, most people recover within 3 to 6 months.

Identity theft in Chicago isn’t going away. But you’re not powerless. Every year, thousands of people stop it before it starts. They freeze their credit. They use strong passwords. They check their statements. They report the first sign of trouble. You can too. It’s not about being perfect. It’s about being consistent. One step today could save you a year of headaches tomorrow.